For the past decade, Europe’s fibre-to-the-home (FTTH) agenda has been dominated by a single metric: coverage.

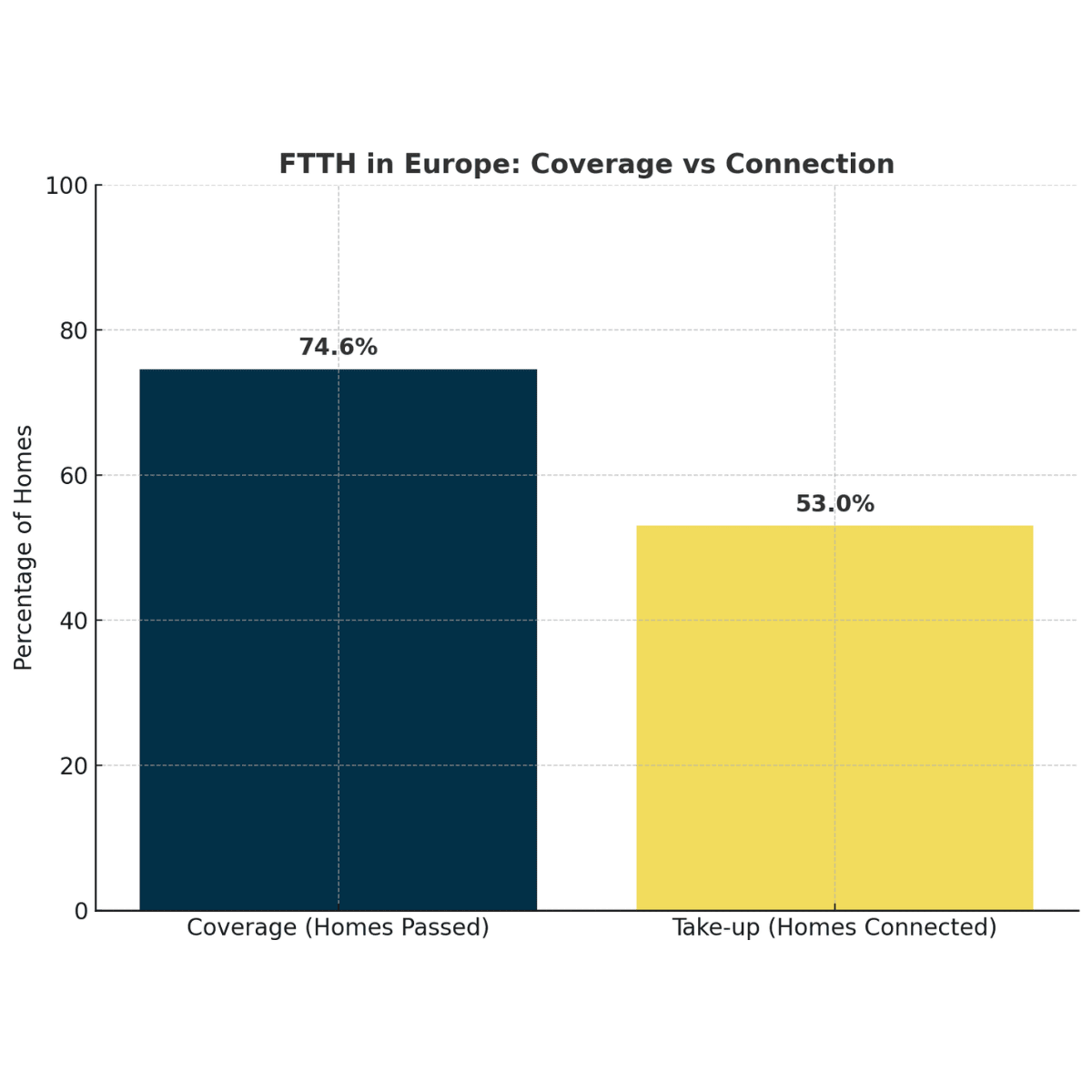

Success was defined by how many homes were passed with fibre. The results are impressive. According to the FTTH Council Europe, as of early 2025, FTTH/B coverage across EU39 reached 74.6%, with EU27+UK at around 69%.

But there’s a catch. Of all those homes passed, only 53% are actually connected. Nearly half of Europe’s fibre-ready households are still sitting on legacy technologies. The capital has been spent, the ducts are laid, but the revenues and customer experience gains remain unrealised.

This is the real battle of FTTH: shifting focus from building networks to activating customers.

The Economic Stakes of Low Take-Up

Each home passed but not connected represents stranded capital. Fibre rollout is front-loaded in cost; returns come only when customers migrate and pay. In 2024 alone, Europe added around 25 million homes passed, yet take-up increased by only 3.4 percentage points.

At scale, this imbalance is dangerous. Industry studies estimate Europe still needs €200 billion or more in fibre and 5G investment to hit full gigabit coverage. Investor confidence will depend less on how many kilometres are dug and more on how effectively operators can monetise the access already in place.

Country Lessons: What Works, What Doesn’t

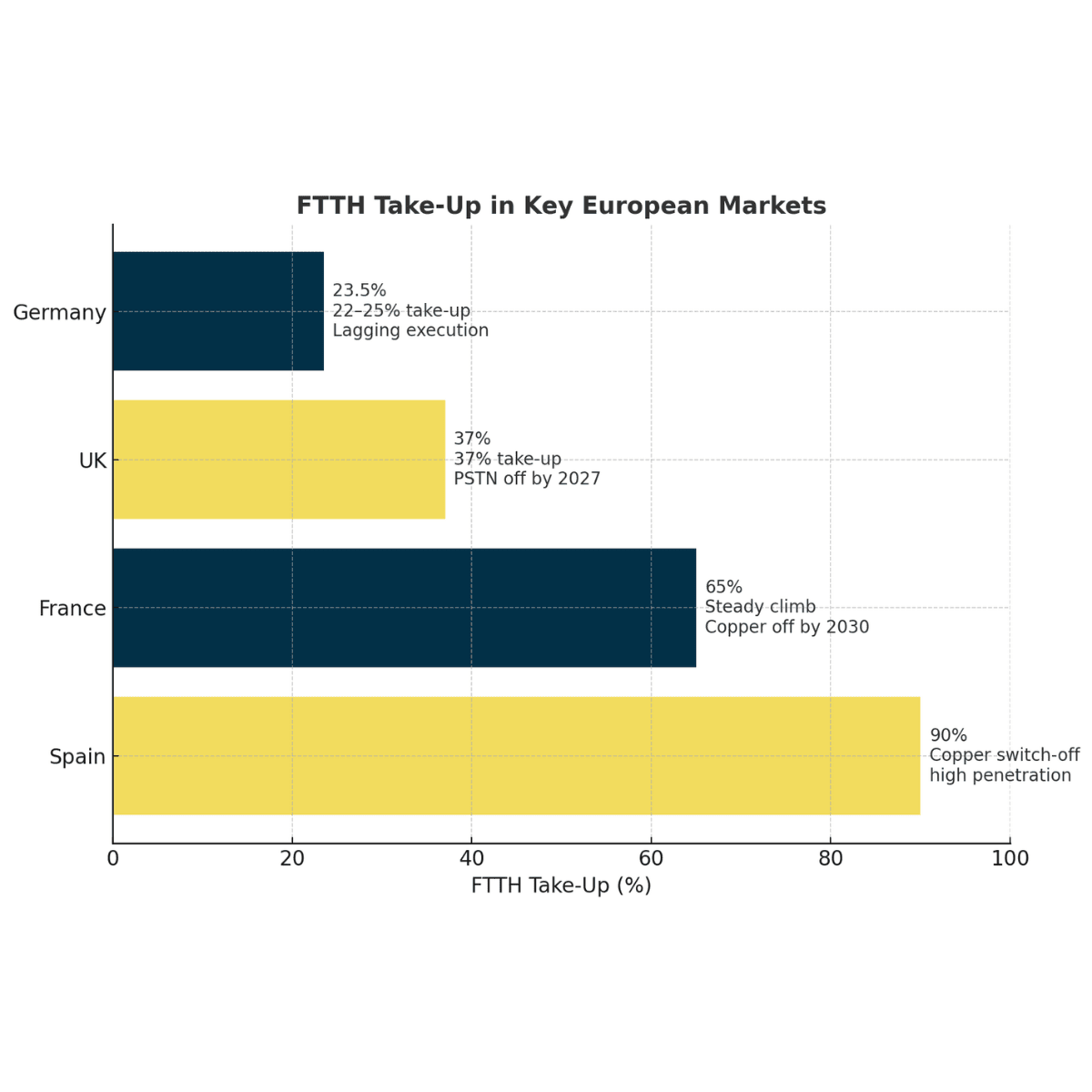

- Spain: The benchmark. Spain consistently leads Europe with take-up levels approaching 90%. The success comes from aggressive copper switch-off, disciplined retail migration, and making fibre the default, not the upgrade.

- France: Policy discipline. Orange is executing a staged plan to close its copper network by 2030, with local “stop-sell” deadlines at the exchange level. Customers are being nudged—or forced—onto fibre, ensuring the infrastructure is used.

- UK: Migration by decree. Openreach will retire the PSTN by January 2027. Stop-sell rules mean that once fibre is available in an area, legacy copper products cannot be ordered. The UK’s take-up rate, while still only around 37%, is climbing fast under this framework.

- Germany: The cautionary tale. Despite billions in subsidies and ambitious targets, Germany’s take-up is stuck in the 20–25% range. Permitting delays, fragmented execution, and weak migration policies have left much of the investment underutilised.

These contrasts prove that coverage without activation is a sunk cost, and that regulatory clarity and migration policies make the difference.

Why Customers Don’t Switch

Three recurring frictions explain why many homes passed remain dark:

- Ordering and installation pain points. Long waits, missed appointments, and unclear landlord permissions in multi-dwelling units drive drop-outs.

- Confusing retail propositions. Too many speed tiers, unclear pricing, or heavy promotional churn discourage migration.

- In-home experience gaps. Customers often blame “the fibre” when their Wi-Fi underperforms. Without managed Wi-Fi (mesh, Wi-Fi 6/6E), the perceived value of fibre is lost at the doorstep.

Strategies That Drive Take-Up

- Copper switch-off and stop-sell. Forcing the migration, while politically sensitive, works. France and the UK show that deadlines concentrate operator focus and customer awareness.

- Frictionless install journeys. Operators that pre-qualify permissions, guarantee precise install slots, and improve “first-time-right” rates see higher conversions.

- Managed Wi-Fi as standard. Bundling mesh or managed Wi-Fi ensures customers feel the fibre benefit, reducing churn and boosting word of mouth.

- Simple, visible pricing. A clear entry tier with obvious upsell paths reduces choice paralysis. Spain’s approach—make fibre the default, copper the exception—proves effective.

- Public–private leverage in rural areas. Funds like the Connecting Europe Broadband Fund (CEBF) are unlocking private investment by underwriting risk in low-density, low-ARPU zones.

The Role of Policy: GIA as a Catalyst

The Gigabit Infrastructure Act (GIA), which entered into force in 2024, is designed to cut deployment costs by harmonising permitting, improving infrastructure reuse, and mandating single information points. While it primarily addresses rollout, its knock-on effect is critical: the faster fibre reaches the home, the sooner the activation battle begins. But regulation must go further, supporting copper retirement frameworks and ensuring operators have clear paths to migrate users.

The Operator Checklist for Take-Up Success

To truly win the battle from passed to connected, European operators should manage to a new set of KPIs:

- Conversion rate: % of homes passed that order within 90 days of availability.

- Install lead time: average days from order to activation.

- First-time-right installs: % completed on the first appointment.

- Managed Wi-Fi penetration: % of base with operator-supplied mesh or Wi-Fi 6/6E.

- Stop-sell footprint: % of copper exchanges where fibre-only rules apply.

- MDU clearance rate: % of buildings with permissions secured in advance.

Looking Ahead: 2026 and Beyond

Europe no longer has a “build” problem—it has a conversion problem. Countries that enforce copper switch-off, simplify retail offers, and focus on in-home experience will unlock the returns their investors expect. Those that continue to equate “homes passed” with success risk stranded capital and regulatory backlash.

The message is clear: the fibre wars will not be won in the ducts or on the poles, but in the living rooms of Europe’s customers.

Article by

Yelco

At Yelco, we support operators across Europe in accelerating FTTH adoption, from innovative fibre solutions to smarter in-home experiences. If you want to make every home passed a home connected, get in touch with our team or follow us on LinkedIn for more insights.